Our client SoShop, a digital banking platform, wanted to offer all the features you would expect from a bank, such as debit cards, statements, and account management.

Users have to complete an extensive checklist before they can use their cards. We sped up the process by integrating a number of specialist BaaS applications, such as Jumio, Trezor, and PFS, for identity verification, AML & KYC compliance and card issuance. Once user onboarding is completed, a SoShop debit card is shipped to the user and activated.

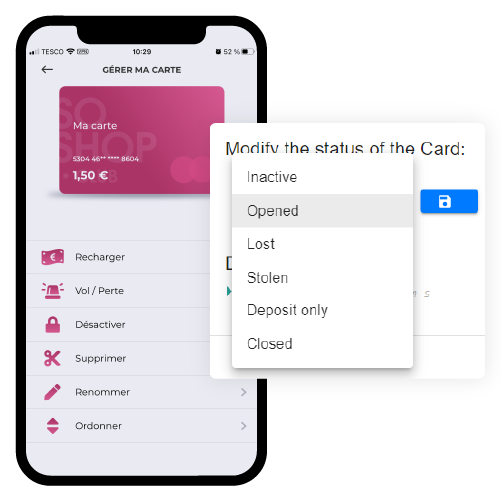

The mobile app includes several features that help users manage their SoShop debit cards in a secure manner: reporting lost or stolen cards, freezing card usage, adding a virtual card or renaming a card.

The Banking-as-a-Software solutions we integrated with the SoShop platform allows the tracking of every transaction which can then be displayed in a statement to the user.

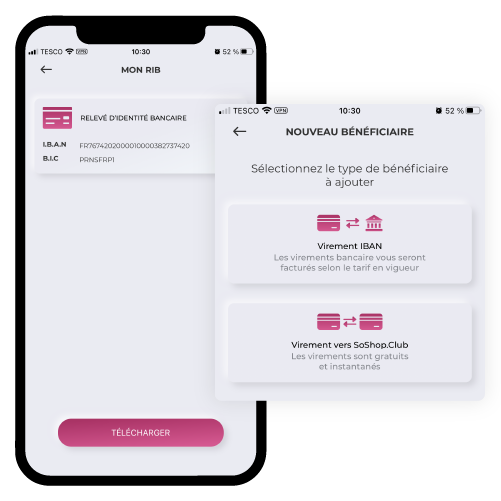

In addition to top-up vouchers, customers can also fund a SoShop debit card via bank transfers (each account has a RIB or IBAN number) or do an instantaneous free transfer from another SoShop card.

Do you have a list of features in mind?

We can help you select and implement the right features for your marketplace.