Creating an online marketplace may seem like a great way to make money. But without a suitable monetization strategy you aren’t going to last long. And successful monetization is only possible if you have a viable business model, which means identifying and optimizing the right marketplace revenue streams.

Far too many would-be entrepreneurs “recognise” the need for these crucial elements of a business, but do not really understand what the terms really mean. These would be marketplace operators say they have a business and revenue model, but when pressed they allude to some vague notions on pricing strategy. This approach is often justified by suggesting that it mirrors the strategy of a successful marketplace, without considering whether the platform they are building is similar to what they are mimicking.

This article will clear up some of the confusion over marketplace business models and revenue streams, break down what the most common marketplace revenue streams are, and how to go about selecting the right ones.

Marketplace Business Model Vs. Marketplace Revenue Streams

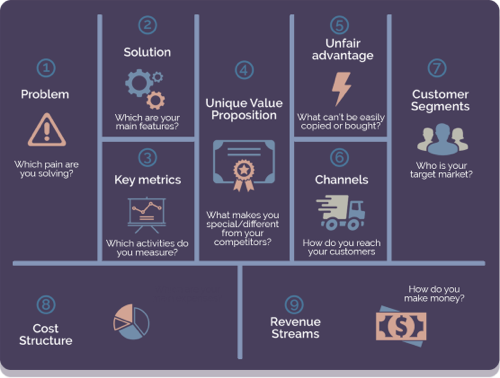

Business and revenue models are often confused as being interchangeable, but in reality the latter is an element of the former. The business model articulates the flow of value in your business, defines the benefits for all the stakeholders, and identifies which products or services will be served to a specific target market. The revenue model, on the other hand, determines how owners can monetise the flow of value between stakeholders within their business systems.

Consider a simple marketplace. A marketplace has three classes of stakeholders: buyers, sellers, and those who maintain the marketplace. If the marketplace is working well, the sellers gain value from having a group of customers that want to buy their offerings. The buyers obtain value from having a place where they can buy the things they need. Value for both sellers and buyers is facilitated by the platform which helps buyers find sellers that offer goods and services that the buyers want. In exchange for this matchmaking, the owner of the platform charges some sort of fee, which is how they gain value for themselves.

The last sentence in the above paragraph relates to the marketplace revenue model; it answers how the owners of the platform make money from people buying and selling things using their infrastructure. Note that the marketplace revenue model only works if the other stakeholders in the platform, the buyers and sellers, gain value from the interaction as well. This is the key distinction between business and revenue models, and why it is crucial that the business model is clearly articulated before looking at revenue.

“A successful combination of a great Business Model and Revenue Model results in a Google of today or a Facebook of tomorrow. But if you place your Revenue Model on the throne and crown it as king, with your Business Model as its slave, then you will land up with a Myspace of yesterday.”

Alok Kejriwal – serial digital entrepreneur

In other words, how a marketplace platform makes its money should be directly tied to the benefits the stakeholders receive. In the first instance, this ensures that the platform operators are incentivized to promote and protect the value the buyers and sellers are receiving from participating in the marketplace.

Secondly, it promotes growth. By incentivizing the creation of stakeholder value in your marketplace, you get more stakeholders. Finally, tying profit to stakeholder satisfaction benefits perception of your brand. A high Net Promoter Score, for example, is usually the sign of a healthy business model.

Manage expectations to get your marketplace revenue model right

Before looking at marketplace revenue options, it is important to understand how getting the revenue model wrong can destroy your business. Most times it comes down to asking the wrong questions. It is relatively easy to figure out how to make money from an online marketplace. It is another thing entirely to figure out how to make the right amount of money. The distinction is crucial.

Every entrepreneur has the occasional daydream of being the head of a multi-billion pound company that allows them to yacht off the coast of the French Riviera. However, not many people are designed to be billionaire entrepreneurs, and many simply do not want to be one. Being the head of such a massive company brings its own stresses, like dealing with investors and managing a huge employee base. Many entrepreneurs just want to be financially comfortable without taking on the burdens associated with a larger business.

Companies like Zaarly and TaskRabbit illustrate the point. These reverse marketplaces (where buyers post their needs and sellers bid on the work), made decent enough revenues for a small business. But not good enough to interest VCs, since they didn’t make enough to justify going public or a ridiculous buy-out price. So these companies had to pivot their business and revenue models to generate more income. These pivots alienated existing stakeholders, while putting the company in flux.

After ensuring that you generate revenue in a way that correlates with the benefits your stakeholders get on the platform, your next step is to align your revenue model with your expectations. A simple platform that will provide a comfortable lifestyle will have a different revenue model than one that is going to be publicly traded. Building models with the end goal in mind is crucial for your success.

Marketplace Business Models

Until now we have described marketplace platforms as if there is a standard format. There is not. There are a lot of different ways to build a successful market; below is a list of some of the more popular formats.

- B2C (Business-to-Consumer). On these platforms, businesses sell their products directly to consumers – or the end-users of the thing being sold. Similar to traditional brick and mortar businesses like grocery and book stores.

- B2B (Business-to-Business). These platforms facilitate the exchange of goods and services between different businesses, where the buyer will not be the ultimate user of what is being purchased.These types of transactions include those between manufacturers and wholesalers, or wholesalers and retailers.

- Reverse or C2B. In this case it is the buyer that advertises what goods or services they need, and sellers bid on providing that need. The buyer is the first mover, while the seller determines whether they can meet that demand. The buyer then chooses the best offer available.

- P2P (Peer-to-Peer). This is a site where individuals exchange goods and services, where the sellers are not necessarily businesses that specialize in the goods or service sold. Examples of P2P markets include eBay and Craigslist.

- Crowdsourcing. This sort of platform is usually reserved for the sale of services, although sometimes goods are exchanged. Crowdsourcing occurs when a customer (generally a business) outsources a function that used to be done by employees to a large network of people in an open call. Sometimes these tasks are done by a large group of people, but generally one person “claims” the job and does it themselves. Examples of crowdsourcing sites include Amazon’s Mechanical Turk and Flickr Creative Commons.

- On Demand. On Demand platforms are a lot like crowdsourcing, only instead of opening up the requests to a large group of people, the platform pairs buyers and sellers based on demand and timely, almost instantaneous delivery. Platforms like Uber and AirBnB are examples of On-Demand Platforms.

Choosing the right marketplace business model requires focusing on the three relationships that exist within the platform:

- Buyer and Seller

- Buyer and Platform Owner

- Seller and Platform Owner

These relationships determine whether the buyer or seller make the first move in your platform’s transaction process and goes a long way towards selecting the right business model.

Types of Marketplace Revenue Streams

Finding the right revenue model uses a similar process as finding the right business model. As stated above, the marketplace’s owner should identify what their long-term goals are. Next, they should evaluate the dynamics of the three relationships listed above and determine where value is being created. Once that has been identified, the revenue should be built around that value creation point while being careful not to charge so high a premium that it takes away the benefit to the users of your marketplace.

Easier said than done. The process for discovering that point will be detailed later. First, a list of potential revenue streams for a new marketplace platform.

- Commission. This is the most common method for monetizing a marketplace. It seems simple at first glance, plus has the potential to be incredibly lucrative for the owner of the platform. Getting a cut of every transaction can add up quickly. However, there is a risk that people will use a platform to find products/services or customers and then complete the transaction off-site to avoid paying the commission.

- Membership/Subscription Fee. The benefit of this model is that it guarantees revenue regardless of whether the transaction is completed on- or off-platform. However, it also poses a barrier to entry which could limit the number of platform users.

- Listing Fee. A model first used with classified ads, the value proposition for both the buyer and seller is that there is a centralized place to display available goods and services. The platform owner does not facilitate the transaction and the listing fee is generally low. The platform makes it money on volume.

- Lead Fee. This is a hybrid of a commission and listing fee model. The seller only pays once a legitimate lead is provided. This revenue model only works when the value of a lead is high, so it is generally reserved for B2B or B2C marketplaces where relationships are long-term. If properly implemented, the amount of the lead fee can be higher than a listing or membership fee due to the long-term value derived from each new relationship.

- Freemium. Freemium works in a marketplace when the platform provides value-added services in addition to basic transactions or features. Basic transactions in a freemium marketplace generally don’t entail costs for the buyer or seller. However, if either party wants additional value, such as insurance or delivery services, the platform charges a premium.

The challenge is to find a service that is valuable enough that people are willing to pay for it, but not so crucial that the transaction is pointless without it. If the platform charges for crucial aspects of the transaction while advertising that such transactions are “free,” it can alienate users.

- Featured Listing and Ads. Featured listings and ads can be used as secondary revenue streams to help diversify a platform’s monetization strategy. By allowing buyers or sellers to pay a premium to feature their goods and services, the platform can generate more revenue without increasing other fees that might drive potential users away.

As you can see there are a host of possible strategies for revenue generation. The question is how to find the best one for a given situation.

Optimize Marketplace Revenue Streams through Experimentation

As we have discussed in the past, there is no substitute for gaining knowledge about a market segment than through a series of minimum viable products (MVPs). Every business starts with a series of assumptions about how their world works – MVPs help you test the validity of those assumptions. The goal of every MVP is to incrementally learn more about your target market. It is not just be about adding features, but about following a process that will transform user value into platform revenue.

Start with a low fidelity MVP to clarify your value proposition to users and determine if they are willing to pay for that value. Once you’ve established interest in your solution, you can move on to a high-fidelity MVP to test revenue streams as part of finding product-market fit. That is, are sufficient numbers of people willing to pay for your solution at a price point that turns your marketplace concept into a sustainable business?

Another option is to benchmark your revenue model with that of established successful comparable marketplaces. The new marketplace basically adopts a version of the “proven” strategy. However, this can be a dangerous approach. The goal of any new company is to establish a competitive advantage, and copying someone else’s model may diminish the possibility of finding one. Different target audiences, market locations, and product categories will almost always require tweaks to the revenue model to accommodate unique needs and preferences.

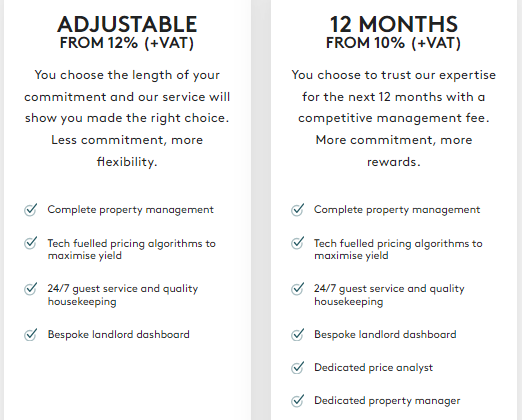

Lastly, identifying sustainable revenue streams for your marketplace is not a once-off process. There is always room to optimise and expand them. Take the case of property management platform Nestify. They had a steady stream of revenue from flat-rated commission fees that they wanted to optimise for more predictable growth. A tiered commission model with a discounted rate for long-term commitment turned out to be a winning solution. Platform revenue growth was further boosted by optimising property owners’ revenue with a yield pricing system similar to the one hotels and airlines use.

The opposite is also true; sometimes a good revenue stream can dry up due to external factors such as changes in consumer needs or new competitors emerging. The latter was the main reason why Ebay stopped charging fees for most sellers in 2024. Niche startups like Depop and Vinted were eating into their lunch and the old-school marketplace wasn’t having it. The change seemed to work with seller activity doubling in countries like Germany.

The bottom line with marketplace revenue streams is that they need to be tested, refined and reviewed if your platform is to have a sustainable feature. Without that effort your business model becomes an empty shell devoid of life.