CobbleWeb has previously written about three important aspects of online marketplace payment flows:

- The importance of choosing the right payment system

- Why we prefer the Stripe payment platform

- Comparing the different Stripe Connect options

In this blog post we will be zooming in on another key part of the marketplace transaction flow: how and when do you make payouts to your sellers?

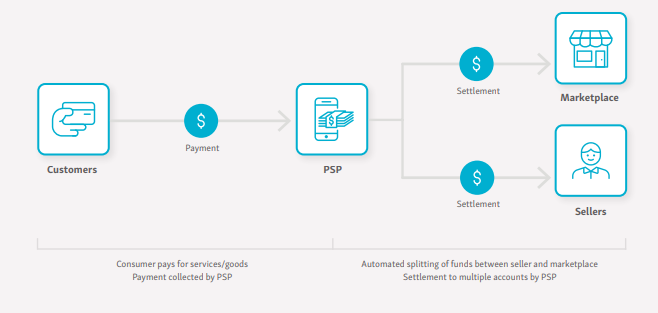

There are usually four players in the transaction flow that lead to marketplace payouts: buyers (customers), sellers or service providers, the payment gateway, and the marketplace owner.

Here’s a simplified sequence of events:

When the buyer orders a product or service a notification is sent to the seller. The seller then has to accept or decline the order. If the seller accepts the order, the sales amount is ring-fenced (by way of pre-authorisation or escrow). Once certain conditions are met (e.g. service rendered or product shipped) the funds are deducted from the buyer’s card, split and transferred to the sellers’ accounts (sale) and the marketplace (transaction fee).

Your payment system thus plays a pivotal role in linking and executing every step in the transaction flow. Get it wrong and unhappy sellers will leave your marketplace because they don’t get paid on time, while buyers will inundate you with chargebacks and payment disputes. A nightmare scenario!

On the flipside, offering timely seller payouts and buyer fraud protection can be a powerful incentive for sellers to use your marketplace.

Payment system requirements for marketplace seller payouts

A marketplace payment system must check a number of boxes in order to deliver a seamless seller payout experience. You will, for instance, need a payment gateway that can receive and transfer funds, often across borders and jurisdictions. Here are some important aspects to keep in mind.

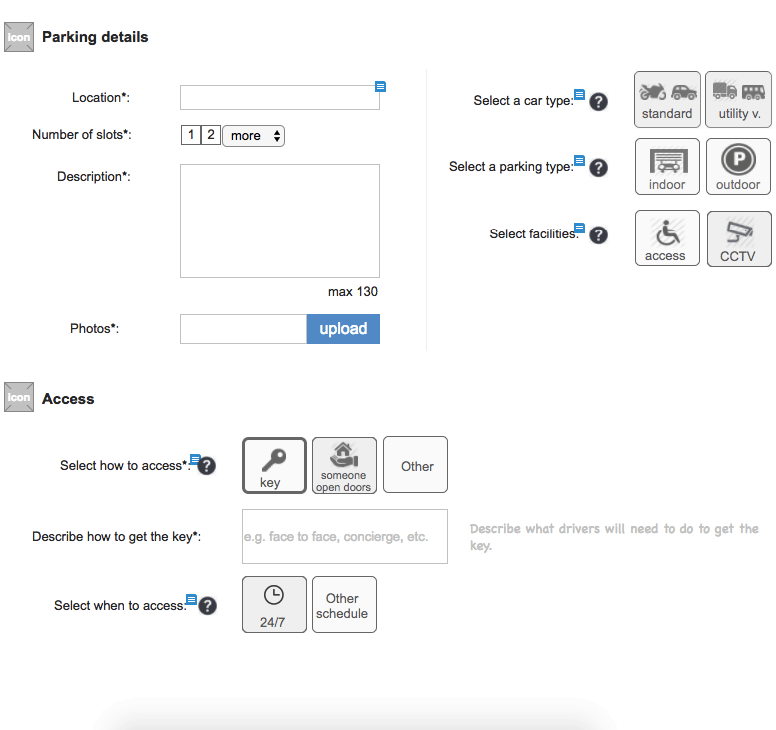

Seller onboarding

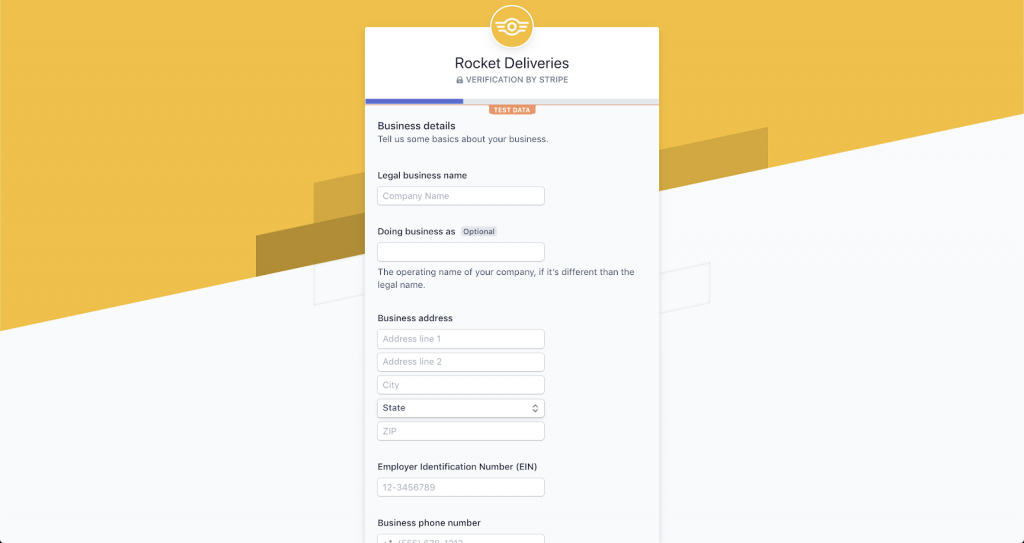

Often overlooked, seller onboarding can make a big difference to the efficacy of your payout process. An onerous administration process can take your eye off your core functions, while unnecessary friction points can frustrate sellers and lead them to abandon your marketplace.

TIP: Stripe’s Connect marketplace payment system will take care of seller onboarding if you create Standard or Express accounts for your sellers.

Compliance with local and international regulations

You will need to verify the identity of all sellers and/or their companies in order to comply with policies that combat money laundering and other illicit financial flows. Verification, in the shape of Know Your Customer (KYC) due diligence procedures, can vary from country to country, but usually includes the scanning of identity documents and the collecting of personal or company details such as legal names and addresses. This complex process is not a once-off burden as it requires regular maintenance to stay up to date with changing regulations.

TIP: You can move the responsibility for KYC identity verification to individual sellers with Stripe Connect Standard and Express accounts. Stripe has also started reducing or postponing the information required to verify accounts, based on seller location and risk evaluation. For example, lower risk accounts in Europe do not have to be verified until the seller has made €2,500 in sales or been on the platform for six months. This reduces the friction for new sellers to join your marketplace.

Tax reporting requirements present another administrative burden for your marketplace. Collecting tax forms, calculating GST, VAT or withholding tax, issuing tax certificates, and generating tax invoices can be a monster of a challenge for a nascent marketplace.

TIP: If you have sellers in diverse VAT jurisdictions, it may be a good idea to advise them in your T&Cs that they are responsible for including VAT in their product prices.

Cross-border transactions

If your marketplace operates in multiple countries you will have to deal with currency conversions and language barriers. International payment costs and currency fluctuations can take a substantial cut out of your sellers’ sales profit.

TIP: The fluctuation of exchange rates between the moment of payment and payout can be addressed by adding a small percentage to the product price exchange rate.

Holding function

Fake product listings and inferior counterfeit goods erode customer trust and hold a huge reputational risk for your marketplace – e-commerce fraud in the UK totalled £359 million in 2019. For security reasons, funds should therefore only be released to sellers or service providers after certain conditions are met. For example, Airbnb pays hosts 24 hours after their guests’ scheduled check-in time.

Seller payout options

Flexible transfer methods can help you reach more potential sellers since seller location, demographics, and sales volumes can all affect preferred payout options. That could mean that you need to cater for e-wallets (e.g. PayPal), mobile banking apps (e.g. Venmo), direct bank deposits, cash collection, prepaid cards, and physical cheques.

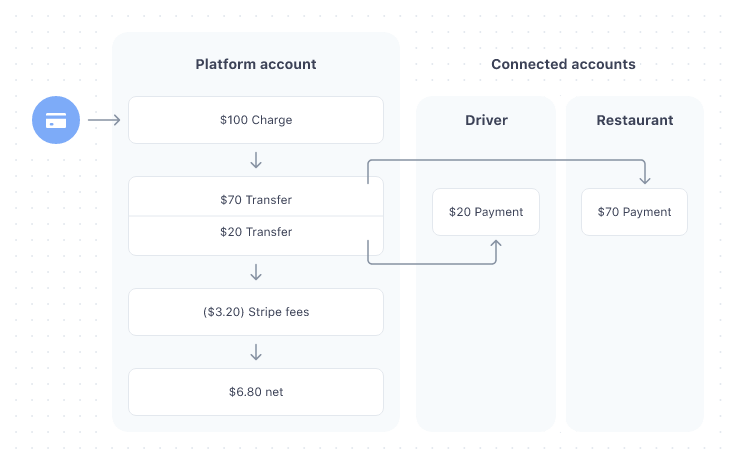

Split payments

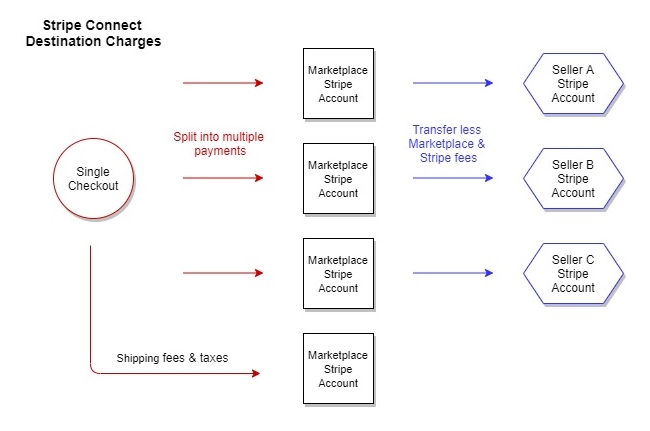

Marketplace transaction flows almost always require separate transfers for seller payouts, marketplace fees, delivery fees or taxes. A platform like Deliveroo, for example, has to split payments between the restaurant, the delivery person and the platform. Retail marketplaces such as Amazon have to split payouts when a shopping cart contains items from multiple sellers.

TIP: Use Stripe Connect’s Separate Charges and Transfers option to pay out multiple sellers after receiving a single shopping cart payment. Your platform processes one payment, which is then distributed to each seller account sans the platform and Stripe fees. Note that this option is only available when sellers are based in Europe, Japan, Australia, New Zealand, or the US. A further restriction is that your platform and the seller account have to be in the same region.

Stripe Connect’s Destination Charges option can be used for sellers based in any country where Stripe is supported. In this scenario, a single checkout is split into multiple payments to your platform account which are then automatically transferred to each seller’s Stripe account after the platform and Stripe fees have been deducted. The only downside with this charge option is that it requires custom coding.

Refunds and chargebacks

Product returns and payment disputes are a fact of life in marketplaces. If you have high transaction volumes, responsibility for administering and issuing refunds should be carefully considered. Note that some payment platforms like Stripe do not always refund their own fees. Your T&Cs will have to communicate this clearly.

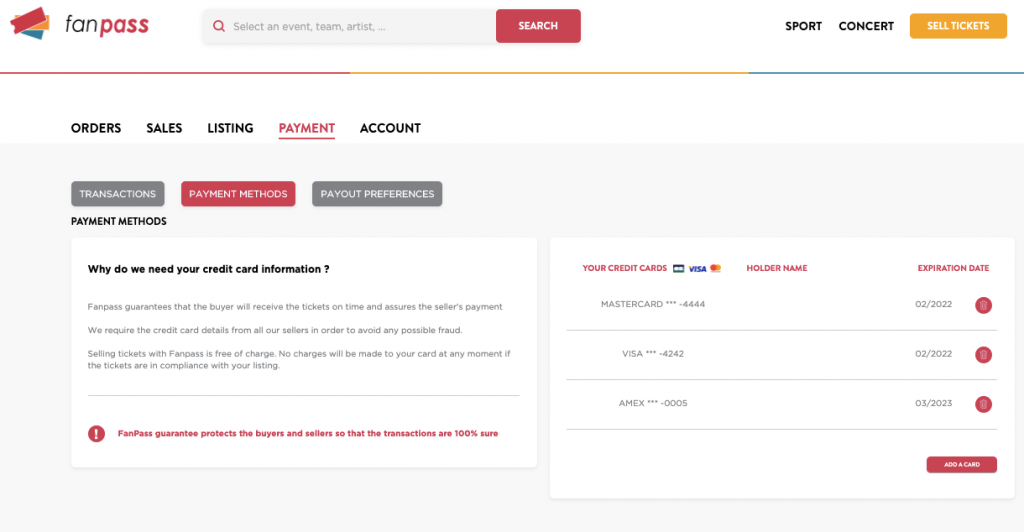

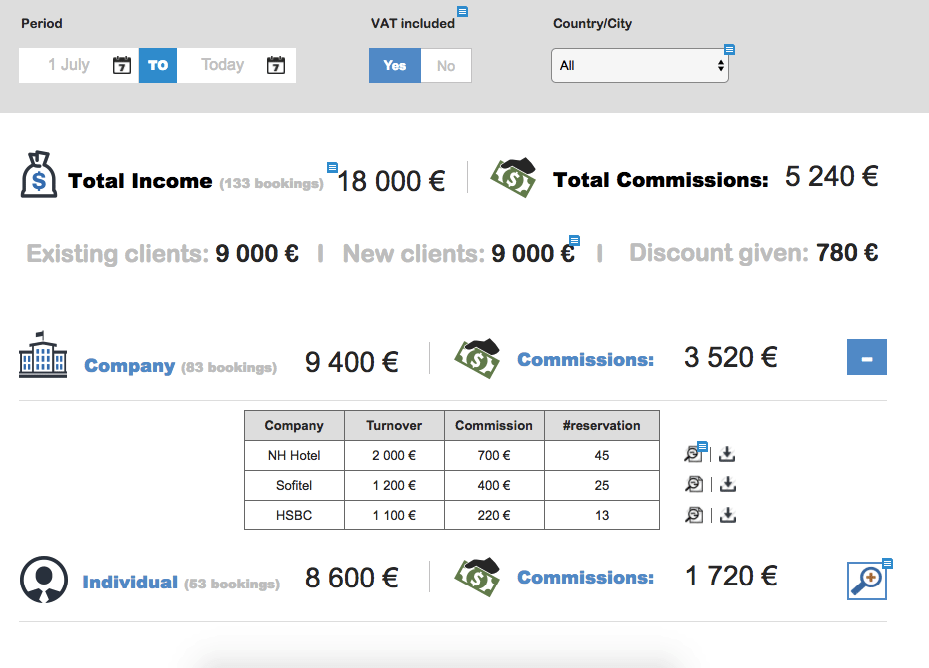

Seller dashboards

Any sellers worth their salt will want to track their sales and payouts. Providing such a granular reporting function in an easy-to-manage dashboard promotes transparency and trust. Dashboards can also be used for payout preferences, tax certificates and other compliance matters.

Scalability

Your marketplace platform should be able to automate all of the above aspects at scale. Its ability to integrate seamlessly with third-party payment service providers will depend on suitable platform architecture and your development resources.

Picking the right payment system for your marketplace seller payouts

Just like your overall payment system, your marketplace payout structure hinges on your business model, user needs and resources. Options range from fully-owned solutions to third-party payment service providers.

DIY: develop your own payout solution

In this scenario the marketplace becomes a licensed payment institution with its own payment gateway. This gives the marketplace owner full control over the payment flow, which includes moving customer payments into its own bank accounts where transaction fees are deducted before payouts are transferred to sellers.

The downside of all this control is that the marketplace owner is responsible for adherence to local regulations, chargebacks and fraud prevention. Subsidiaries with local bank accounts also have to be created (for each country the marketplace operates in) to minimise international payment costs. Escrow accounts can be used to hold funds, but involve a lot of legal red tape and high costs.

There are obviously some strong incentives for high-volume marketplaces to develop their own payment systems. They can mold the payment flow to best suit their business model, better cater to individual seller needs, and minimise payment gateway fees (there will still be fees levied by the payment processor e.g. Worldpay or Chase Paymentech). Since such a proprietary payment system requires substantial technical and financial resources, it is mostly the preserve of enterprise-level platforms such as Amazon.

Third-party solution: payment service providers

Some payment service providers (PSPs), like Stripe, PayPal, MangoPay, and Adyen, have developed specialised payment infrastructure for marketplaces. These third-party solutions remove most of the administrative, technical and legal burdens associated with marketplace seller payouts, which make them perfect for early-stage and growth-stage marketplaces.

Although most PSP payout solutions cover key requirements such as split payments, holding functions, fraud detection and compliance, they do differ from each other in important ways. Some are easier to integrate with your platform, while others offer value-added services such as pre-built user interfaces and seller fraud protection.

PSPs also vary in the currencies, countries, and payout methods they cater for. It is therefore important to align your marketplace with the PSP that caters best to your sellers’ location and banking needs.

| Currencies | Countries | Seller Protection | Hold Period | Used By | |

|---|---|---|---|---|---|

| Stripe Connect | 17 | 40 | No | 90 days | Lyft Deliveroo FanPass |

| PayPal for Marketplaces | 25 | 200 | Yes | 30 days | AliExpress Grailed Rocketr |

| MangoPay | 15 | 114 | No | Unlimited | Vinted WeTravel Wallpop |

| Adyen MarketPay | 33 | 33 | No | ??? | Etsy Uber eBay |

An additional consideration is the PSP’s cost structure. Adyen’s volume deals may make sense for established marketplaces, but are probably not the right fit for startups trying to prove product-market fit. For comparison, Stripe Connect charges £0.10 plus 0.25% per payout, while MangoPay payouts are free to the Euro zone.

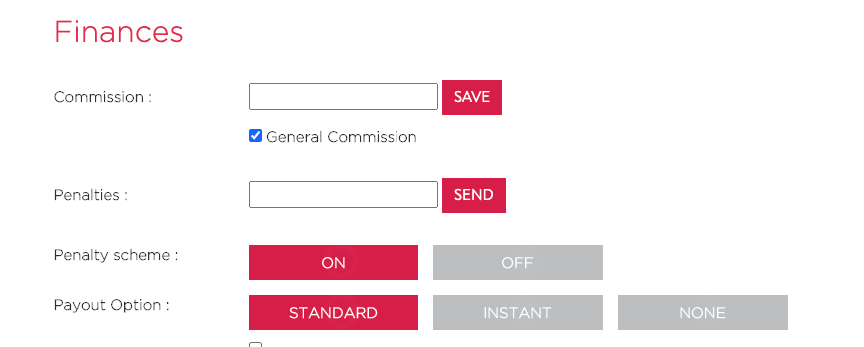

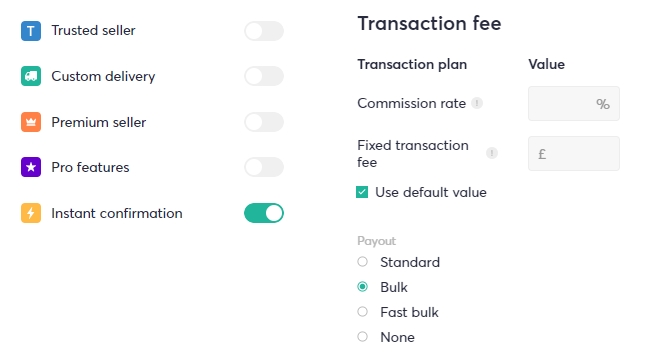

You also want to check your level of control over the payout flow. For instance, the ability to switch between manual and automated payouts allows marketplace startups to test seller behaviour in a more granular manner. Incremental onboarding, instead of collecting all seller information upfront, can reduce friction for new sellers. Customising the commission rate for different types of sellers can be a valuable selling point.

Services can also vary within a PSP’s own offering. If you are using Stripe Connect with Standard accounts, the individual sellers are responsible for disputes. With Custom and Express accounts, your platform is ultimately liable for chargebacks if there are not enough funds in the individual seller accounts.*

*PSPs that support 3D Secure authentication can move the responsibility for credit card chargebacks from your marketplace or individual sellers to the credit card company.

In summary, the main drawbacks of PSP payout solutions are less control over the user experience (e.g. seller onboarding) and market or currency limitations. That is mostly outweighed by their eminent scalability via the automation of the payout process.

When do you make marketplace seller payouts?

In order to decide when to pay out funds to sellers, you have to weigh up two competing factors: the seller user experience and your marketplace risk. Paying out sellers without checking that the goods or services have been delivered can cause financial and reputational losses, while delaying payments can alienate sellers. It’s thus a good idea to use an MVP to test user satisfaction and minimise platform risk.

Generally it is a good idea to only release marketplace seller payouts once certain conditions are met. Your business model will determine which triggers release funds to sellers. Here are some examples:

- Once the product has been shipped and a tracking number has been issued

- On completion of the service or when the booking has ended

- A number of days after the payment was made

- Scheduled intervals: daily, weekly, or monthly

- Instant payouts that occur immediately after payment is received

- Stripe Connect Standard accounts allow sellers to manage their own payout schedule

Using multiple payout triggers to accommodate different types of sellers can be a great selling point for your marketplace. For example, FanPass, an event ticketing platform, offers three payout levels. A standard option only pays sellers seven days after the event (to prevent duplicate or invalid tickets), while an instant option pays qualified sellers (who met certain sales and service thresholds) immediately after receipt of the tickets by buyers. A third option caters for large corporate clients who receive monthly bulk payments.

Any delay before payouts are made entails keeping funds on ice in some way. MangoPay uses an escrow account which allows for indeterminate holding periods. Stripe follows a pre-authorisation route in which a temporary block is put on the amount in the buyer’s bank account. Note that pre-authorisations are only available for credit or debit card payments.

Manual or automatic payouts?

Should you schedule payouts manually or automatically? It makes sense to go the manual route initially to iron out any unforeseen bugs. Once your platform starts to scale and transaction volumes increase you can implement an automatic payout flow.

FanPass scaled their seller payouts with a custom bulk payout feature that automates seller payouts based on variables such as sales volume, seller status, outstanding penalties, and event type. Sellers can be paid out at different speeds (Standard, Bulk, Fast Bulk) subject to volume thresholds, trusted seller status, or a higher commission rate.

Added value for marketplace sellers

The easier you make life for your sellers, the higher their loyalty to your marketplace. You can do this by adding valuable associated benefits to seller payouts.

Extra layers of security is a huge plus for sellers wanting to avoid payout risks. Utilising well-known protocols such as 3D Secure inspire trust, while insurance programs can protect sellers against chargeback and refund losses.

Tax compliance is another area where your marketplace can add extra value. If you use Stripe Connect as your PSP, you can provide tax reporting tools, such as generating 1099-K and W-9 forms for US-based sellers.

User dashboards can help your sellers manage their business better. Allowing them to access detailed information on payouts, marketplace fees, refunds and chargebacks will make your platform more indispensable.

The regulations around seller payouts make it one of the more complex aspects of building an online marketplace. Integrating the wrong technology can cost you dearly when you are ready to grow but are held back by non-compliant or hard-to-scale payout infrastructure.

First-time marketplace entrepreneurs should ideally get some expert advice before implementing a payment system in general and a payout flow specifically. For an overview on marketplace payment systems read our post: Is your payment system fit for a marketplace startup?